The financial industry represents one of the most competitive online environments. Banks, investment platforms, insurance providers, and payment systems vie intensely for user attention in a landscape filled with options yet defined by a scarcity of trust. While advertising can yield results, it is often costly and temporary. Increasingly, users are discovering services through search engines – where the genuine connection with potential clients begins.

This article explores how SEO for financial services enables brands to build trust, attract high-quality leads, and succeed in a digital ecosystem where a single click can be decisive. You will learn effective strategies for 2025, common pitfalls that undermine visibility, and actionable steps to ensure your project consistently generates leads and revenue.

Why SEO for Financial Firms Drives Growth in 2025

Before we delve into specifics, it’s important to understand what SEO for financial services companies entails and how it differs from standard website optimization.

What is SEO for Finance Companies?

SEO for financial services goes beyond optimizing for keywords like “online loan” or “open an investment account.” It is a strategic effort to establish credibility and trust. In finance, trust is the foundation of success.

The goal of financial services SEO is not merely to generate traffic, but to attract users who are ready to take action – whether that’s applying for a loan, opening an account, or scheduling a consultation. This requires a deep understanding of user search behavior, the terminology they use, and the obstacles that prevent them from converting.

How People Choose Financial Services: From Search to Trust

Financial decisions are rarely impulsive. Users research options, compare terms, read reviews, and then make a choice. A single misstep can drive them to a competitor.

Your website must not only rank highly in search results but also inspire confidence. From the page layout to the wording, every element should convey reliability. This is the essence of SEO for financial websites: reassuring users that your platform is a secure and trustworthy choice.

Why the Financial Sector Stands Apart: YMYL, Competition, and Transparency

Google and other search engines apply stringent standards to financial websites, categorizing them as YMYL – “Your Money or Your Life.” Content errors, questionable sources, or a lack of demonstrated expertise can significantly harm rankings.

This is compounded by intense competition, with hundreds of banks, insurers, and microfinance firms competing for top positions. Success requires more than just publishing content or fixing technical issues – it demands proving your expertise, reliability, and adherence to regulatory standards.

How Search Engines are Evolving: AI, Personalization, and Voice Search

By 2025, search algorithms have become far more sophisticated. They analyze user behavior, context, preferences, and even the tone of queries. Voice search, AI assistants, and personalized results are now standard.

SEO for financial institutions is no longer just about keywords. It’s about creating content that answers real questions and builds trust from the first interaction, supported by technical optimization to ensure speed, usability, and clarity for both users and algorithms. This is especially critical in finance, where algorithms actively penalize subpar content or slow sites.

SEO for financial websites now requires deep insight into audience behavior and AI-driven tools, not just a superficial knowledge of algorithms.

Challenges Hindering SEO for Financial Services Providers

Financial companies often face unique obstacles:

- Legal constraints that limit content flexibility.

- Protracted internal content approval processes.

- A reluctance to share specific details publicly.

- Technical website errors that undermine rankings.

- Weak or unnatural backlink profiles.

Many also overlook reputation management, which is essential for SEO for financial firms to deliver lasting results.

Therefore, SEO for the financial industry is more than just marketing – it is a blend of analytics, content strategy, user experience, and public relations. Only this holistic approach can secure strong rankings and earn audience trust.

SEO Marketing for Financial Services: Goals, Audience, and Metrics

Let’s now turn to practical steps. We will outline how to build a strategy for SEO for finance companies, the tools to use, and the approaches that yield the best outcomes.

Laying the Groundwork: Goals, Metrics, and Growth Targets

Every SEO for financial services providers strategy begins with a clear purpose. Without defined objectives, optimization becomes a scattered effort: content is created, links are built, rankings may improve – but leads remain elusive.

The primary goal of SEO for finance is not just traffic – it’s increasing revenue and reducing customer acquisition costs. Establish clear metrics to track progress:

- KPI (Key Performance Indicators): Monitor organic traffic growth, keyword rankings, and lead volume.

- ROI (Return on Investment): Measure SEO costs against the revenue generated.

- LTV (Lifetime Value): Calculate the total revenue a client brings over their relationship with your business.

For instance, in SEO for financial institutions or SEO for finance companies, it’s crucial to track not just lead volume but also conversion rates. If leads aren’t converting, the strategy needs adjustment.

Defining Your Audience: Segmentation and Needs

Financial audiences are diverse, divided into distinct segments with unique needs, challenges, and communication preferences.

The two primary segments are:

- B2C (Business-to-Consumer): Companies offering financial products or services directly to individuals.

Examples:- Banks providing personal loans and savings accounts.

- Insurance firms offering individual policies.

- Investment and brokerage platforms for retail investors.

- Microfinance organizations and consumer lending services.

- B2B (Business-to-Business): Companies delivering financial solutions to other businesses, focusing on corporate finance, risk management, and investments.

Examples:- Corporate banks offering business loans or working capital credit.

- Insurers providing commercial policies (e.g., property or liability coverage).

- Payment processing and accounting services for companies.

- Investment and consulting platforms for corporate clients.

Within these, specialized subsegments include:

- Fintech and Startups: Dynamic projects that require agile, technology-driven solutions. SEO for financial businesses here emphasizes rapid traffic growth and establishing industry authority.

- Local Financial Companies: These businesses focus on geographically specific services. For finance website SEO, users search for “accounting services in Prague” rather than “online accountant.” Local relevance is paramount.

- Wealth Management and Private Banking: A premium segment serving high-net-worth individuals (HNWI), focusing on wealth management, investment planning, tax structuring, and inheritance. Promotion prioritizes confidentiality and personalization.

- Regulation-Tech (RegTech) and Compliance: Firms providing software for regulatory compliance (KYC, AML), risk management, and reporting.

- Finance for Vertical Markets: B2B niches targeting specific industries like retail, IT, or construction, where understanding sector-specific challenges is crucial.

- Infrastructure Segment (B2B2X): Companies offering “Banking-as-a-Service” (BaaS) or API platforms, serving other businesses in B2B2C or B2B2B models.

Effective SEO for financial companies requires tailoring strategies to your specific segment and subsegment, creating targeted funnels, content, and keywords. A generic approach is insufficient.

Mapping the Customer Journey: From First Search to Conversion

Users rarely convert immediately, especially in finance. Their journey typically includes:

- Problem Awareness: Searching for information, e.g., “how to choose an insurance provider” or “safe investment options.”

- Solution Comparison: Reviewing rankings, comparisons, and terms. Expert content, infographics, and case studies are essential here.

- Partner Selection: Seeking specific offers like “buy insurance online” or “open a bank account.” Commercial pages and clear calls-to-action (CTAs) must perform well.

- Decision-Making: Brand trust and site usability are the final determinants of conversion.

Mapping the customer journey is vital for SEO for financial websites, as it helps identify the user’s stage and corresponding content needs.

A well-aligned strategy integrates business goals, audience needs, and the user journey, transforming SEO for financial services into a powerful system for lead generation and revenue growth.

Building Trust and Navigating Search Filters: E-E-A-T and Compliance

While e-commerce sites focus on transactions, financial brands must demonstrate trustworthiness. Users will not engage if they sense doubt, and search engines like Google penalize sites that appear unreliable.

Why Financial Websites Must Be Flawless

Financial content is highly scrutinized in search results. Errors in advice, inaccurate data, or questionable links can severely damage rankings and reputation. As YMYL sites, financial platforms are held to the strictest quality standards.

For financial services SEO companies, this is a central concern. Untrustworthy content is demoted by algorithms and abandoned by users. Two principles are fundamental: E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) and Compliance – adherence to financial laws and regulations.

- E-E-A-T: Assesses the credibility of authors and websites, evaluating expertise, accuracy, source transparency, and content structure.

- Compliance: Ensures content aligns with legal and regulatory standards, which is critical for SEO for financial institutions, insurance websites, and financial consultants.

Without a strong foundation in these areas, efforts in SEO for finance companies are ineffective, as algorithms will not rank untrustworthy sites.

Proving Expertise and Content Authority

In finance, simply publishing articles is not enough. You must demonstrate that authors are genuine experts and the site is a credible source.

To strengthen expertise:

- Authorship and Bios: Prominently display author credentials, professional experience, and education. For consultants or analysts, include links to LinkedIn profiles or industry publications.

- Data and Sources: Reference official reports, global ratings, or research from established firms to build trust and improve search engine perception.

- Editorial Transparency: Explain your content verification, editing, and approval processes to boost credibility.

- Visual Evidence: Use screenshots of reports, data tables, charts, or audit results to add authority and clarity.

For SEO for financial services companies, practical experience is key. Sharing case studies, client results, and implementation examples positions you as a proven expert.

Fostering Trust: Transparency and Security

Trust in finance is built on clarity, not promises. Transparent terms, accurate data, and genuine reviews are essential for retaining users. Omitted licenses or legal details can shatter confidence instantly.

To build reliability:

- Display legal information and licenses prominently.

- Include a risk disclosure section for investments or loans.

- Use SSL certificates and secure forms to ensure data safety.

- Feature verified reviews and ratings, avoiding fake testimonials.

For SEO marketing for financial services like banks and insurers, these elements are non-negotiable. A single missing document can harm rankings, even if the content itself is flawless.

Example: Capital One’s Banking Security page.

How E-E-A-T Enhances Rankings

Search engines prioritize sites that demonstrate experience, expertise, and transparency. For example, when comparing two investment sites, the one with verified authors, links to regulators, clear company details, regular content updates, and evident compliance will rank higher.

This approach not only boosts rankings but also minimizes risks, ensuring stability during algorithm updates.

E-E-A-T is the bedrock of SEO for financial institutions. Without trust, there are no clicks; without clicks, no conversions; without transparency, no sustainable business. In finance, successful SEO for financial services begins with establishing credibility and expertise.

Technical SEO: The Foundation for Sustainable Growth

SEO for financial services cannot succeed without a robust technical foundation. Even the best content will underperform if pages load slowly, links are broken, or search engines cannot index the site properly. Technical optimization is the essential first step toward consistent growth.

Site Structure and Search Engine Accessibility

Search engines view websites as interconnected pages. A confusing structure can prevent crawlers from indexing key content. For financial sites, this is critical: a single missed page detailing rates or loan terms could cost numerous leads each month.

For effective SEO for financial companies, ensure a logical site structure:

- Hierarchy: Organize content from broad categories to specific pages, e.g., “Home → Services → Loans → Cash Loans.”

- Three-Click Rule: Users should be able to reach any important page within three clicks.

- Sitemap (sitemap.xml): Helps search engine robots find new or updated pages efficiently.

- Robots.txt: Instructs robots on which pages to index or ignore.

- Internal Linking: Connect related content, such as articles, calculators, and product pages, to enhance navigation and user retention.

When planning finance website SEO, manage your crawl budget – the limited resources search engines allocate to scan your site. Avoid wasting it on duplicate or low-value pages to ensure key sections are indexed.

Speed, Core Web Vitals, and Security: Essential Trust Signals

Financial users expect speed; many will abandon a site that takes longer than three seconds to load. Search engines also prioritize speed as a key ranking factor.

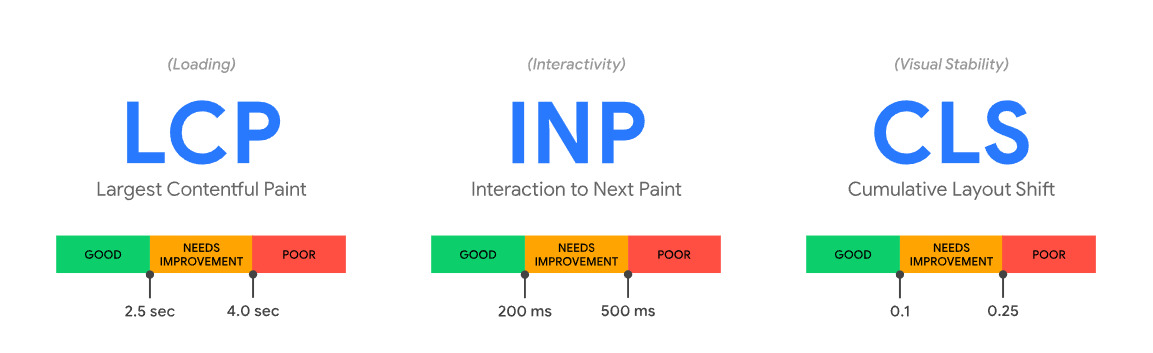

Core Web Vitals measure the technical quality of a page from a user perspective:

| Metric | Meaning | Recommended Value |

|---|---|---|

| LCP (Largest Contentful Paint) | Time to load the main content | Under 2.5 seconds |

| INP (Interaction to Next Paint) | Responsiveness to user actions | Under 200 milliseconds |

| CLS (Cumulative Layout Shift) | Visual stability, preventing element shifts | Under 0.1 |

Additionally:

- HTTPS Certificate: Essential for ranking and avoiding “not secure” browser warnings.

- Security Audits: Protect user data, which is crucial for SEO for payment systems and financial apps.

- Mobile Optimization: With over 60% of queries coming from smartphones, non-responsive pages will lose users and rankings.

Structured Data: Communicating with Google

Structured data – code that describes your content – helps search engines understand and display your site accurately, enabling rich snippets like star ratings, FAQs, or pricing information.

For financial sites, use relevant schema.org types:

- Organization: Details about your company, including name, contact information, licenses, logo, and address.

- Product: Descriptions of services like loans, insurance policies, or investment products.

- FAQ: Questions and answers that can enhance visibility and support E-E-A-T.

- Review/Rating: Client testimonials, which are vital for SEO marketing financial services.

Structured data can boost click-through rates by 15–30% by making your search results more prominent and informative.

Example: Checkout.com’s FAQ snippet.

Local and International SEO: Connecting with Your Audience

For businesses operating across regions or countries, search engines need clear signals about your location and target audience.

- hreflang: Defines language and regional versions for different countries like the USA, Canada, and UK, aligning with local regulations and currencies.

- NAP Data (Name, Address, Phone): Ensure consistency across online directories and your own site, a key aspect of local SEO tips for financial services.

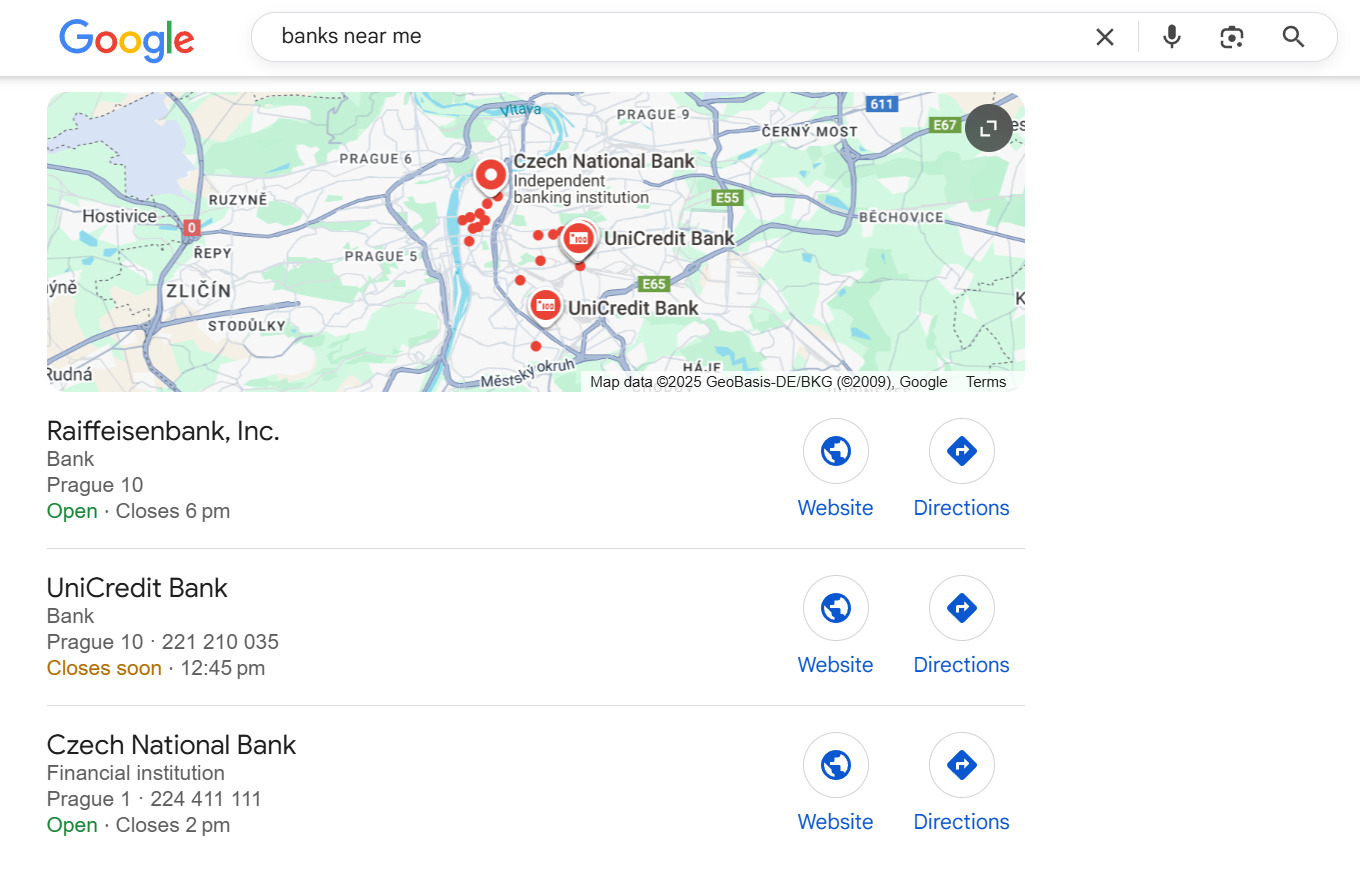

- Google Business Profile: Enhances visibility and trust for queries like “insurance nearby” or “financial consultant Prague.”

- Local Branch Pages: Create individually optimized pages for each office or service region.

SEO for international projects requires adapting to local currencies, legal details, and native-language translations.

Technical SEO is more than just fixing errors – it’s a systematic effort that drives long-term stability, visibility, and trust. A strong technical base allows you to maximize results from your content and link-building efforts.

Keywords and Content Architecture: Creating a High-Impact System

Content is the core of SEO for financial services companies. To generate qualified leads, avoid generic articles on “loans” or “investments.” Instead, understand your audience’s search patterns, the phrases they use, and the pages that truly address their needs. A strategic content architecture is designed to capture all demand, from informational queries to commercial intent.

Finding Keywords for SEO Finance Services

The financial sector is complex: competition is intense, and search queries are often long, specific, and driven by clear intent. Relying solely on high-volume keywords is insufficient. You need a precise analysis of user behavior and conversion potential.

Keyword research involves several steps:

- Demand Analysis: Use tools like Ahrefs, Semrush, or Google Keyword Planner to assess search volume, difficulty, and related queries.

- Search Intent: Identify the user’s goal – whether they want to learn, compare, or buy. For example, “what is an investment portfolio” (informational) vs. “open a brokerage account online” (commercial).

- Conversion Focus: For SEO for financial firms, prioritize keywords that are likely to lead to actions like registrations or account funding.

- LSI and Related Terms: Incorporate semantically related keywords and synonyms like “financial consultant,” “investment strategy,” or “bond yields.”

Segment your keywords by themes to create a targeted content plan.

Thematic Clusters: Structuring for Success

For steady, authoritative growth, your content must be logically interconnected. Thematic clusters – groups of pages centered around a core topic – achieve this.

Example clusters for financial sites:

- Banking: Loans, credit cards, deposits, refinancing.

- Investments: Brokerage accounts, ETFs, cryptocurrencies, trading platforms.

- Insurance: Auto, health, life insurance.

- Accounting and Taxes: Outsourcing, automation, tax deductions.

- Fintech and Startups: Payment systems, mobile apps, financial platforms.

Each cluster should have a pillar page (e.g., “A Guide to Online Investments”) and supporting pages (e.g., “Stock Investments for Beginners,” “How to Start Investing,” “Choosing a Broker”).

This structure enhances topical relevance, improves site navigation, and helps Google recognize your expertise – a critical factor for SEO for financial services providers.

Content Mapping: Planning for Impact

A content map outlines all necessary pages, their relationships, and their role in the sales funnel. Without it, your site risks becoming a disorganized collection of posts that don’t support business objectives.

A typical SEO finance content map for financial organizations includes:

| Page Type | Purpose | Examples |

|---|---|---|

| Service Pages | Promote specific products or services | “Secured Loan,” “Open an Investment Account,” “Accounting Support” |

| Blog/Analytics | Educate the audience and build trust | “How to Choose the Right Insurance,” “Fintech Trends in 2025” |

| Calculators/Tools | Increase user engagement and time on site | “Mortgage Calculator,” “Investment Return Estimator” |

| Research/Case Studies | Demonstrate expertise and real-world results | “How Bank X Increased Client Deposits by 30%” |

| Guides/FAQs | Answer common questions and reduce support load | “How to Claim Tax Deductions,” “A Step-by-Step Guide to Buying Insurance Online” |

Optimize each page for its specific query type – calculators and service pages for commercial keywords, blog posts for informational ones.

Financial marketing search engine optimisation benefits greatly from interactive content like calculators, charts, and quizzes, which keep visitors engaged and can attract natural backlinks.

Adapting for Voice and Local Search

With the rise of AI assistants and smart devices, voice search has become mainstream. Users ask questions like, “Which bank has the best mortgage rates?” or “Where can I buy insurance nearby?”

To optimize for this:

- Use natural, question-based phrasing in subheadings to match how people speak.

- Include FAQ blocks with direct, concise answers, as these are often pulled for voice search results.

- Target local queries: Ensure your site includes addresses, phone numbers, business hours, and local reviews. This is essential for SEO for financial websites, insurance services, and local lenders.

- Apply structured data (like LocalBusiness or Organization) to help AI understand and use your content.

A robust content architecture and strategic keyword plan form the backbone of successful SEO for financial services, uniting strategy, content, and technical optimization into a powerful system for growth.

Content Strategy and On-Page Optimization: Crafting a Site That Persuades and Converts

Effective financial content does more than drive traffic – it builds trust, demystifies complex topics, and guides users toward action. Achieving this requires a systematic approach: from meticulous content planning to precise on-page optimization. This is vital for SEO for financial companies, where every word must be accurate, verified, and confidence-inspiring.

Trustworthy Content: Guides, Calculators, and Real Stories

Financial audiences are cautious and skeptical of vague promises. Your content must be practical, evidence-based, and grounded in real-world experience.

Guides and Analytics

Comprehensive, step-by-step guides such as “How to Select an Investment Platform” or “Strategies for Reducing Small Business Taxes” often outperform purely promotional copy by demonstrating a deep understanding of client needs.

Interactive Calculators and Tools

For SEO for finance industry and financial apps, interactive tools like mortgage calculators or investment return estimators significantly boost user engagement, lower bounce rates, and strengthen positive behavioral signals for search engines.

Case Studies and Research

Showcase tangible success stories: how your clients have increased returns, optimized taxes, or mitigated risks. Case studies are particularly powerful for SEO for financial brokers and accounting services, providing concrete proof of your expertise.

Educational Content

Financial topics can be intimidating. Explain industry terms, clarify regulations, and offer glossaries to aid user understanding and signal authority to search engines.

Structuring Pages: Metadata, Headings, and Clarity

On-page optimization prioritizes clarity. Even excellent content will fail if its structure is confusing or its meta descriptions are vague.

Meta Tags

- Title Tag: Should be specific and include primary keywords, e.g., “Mortgage Calculator – Calculate Your Payment Online.”

- Meta Description: A compelling, benefit-driven summary with a call to action, e.g., “Estimate your monthly payment and explore current mortgage rates in 30 seconds.”

- Headings (H1, H2, H3): Organize content logically and highlight key sections for both users and search engines.

Headings

Use natural, descriptive phrasing that incorporates keywords without overstuffing. Each subheading should address a specific user question or topic.

Internal Links

Connect related pages contextually. For example, link from an article about loans to a relevant calculator, or from a case study to a consultation booking page. This improves site navigation and helps search engines understand your content’s relationships.

Image Optimization

Use descriptive alt tags for images, such as “chart showing investment portfolio growth over time,” to improve accessibility and image search visibility.

High-Converting Formats: FAQs, CTAs, and Data Visualization

Financial sites must both inform and guide users to action, effectively blending text, visuals, and interactive elements.

FAQ Blocks

Place FAQ sections at the bottom of relevant pages to answer common questions like “What documents are needed for a loan application?” or “How do I buy insurance online?” This boosts SEO for financial portals and improves performance in voice search.

CTA Blocks

Use clear, action-oriented CTAs like “Apply Now,” “Get a Quote,” or “Book a Consultation,” and position them strategically throughout your pages.

Video and Data Visualization

Charts, diagrams, and short explainer videos help retain user attention. A video explaining how a payment system works can significantly enhance engagement for SEO for financial services B2C.

Interactive Elements

Quizzes, checklists, and surveys keep users engaged and can encourage social sharing, which improves behavioral metrics and organic reach.

Link Building and Digital PR: Boosting Authority and Rankings

Strategic link building is a critical component of SEO for financial services companies, banks, and investment platforms.

Why Links Matter in YMYL

Google rigorously evaluates YMYL (Your Money or Your Life) sites. Backlinks from trusted sources – such as industry media, reputable publications, or professional associations – act as strong signals of credibility, directly influencing search rankings.

Quality backlinks:

- Strengthen your site’s E-E-A-T profile;

- Accelerate ranking growth in competitive niches;

- Drive sustainable, branded traffic that is difficult to achieve through advertising alone.

Effective Financial Link-Building Strategies

- Industry Media Publications: Publishing articles on established financial portals or business outlets on topics like “Fintech Trends in 2025” or “The Impact of Fed Rates on Investments” can attract high-quality, relevant links.

- Research and Analytics: Original research, such as proprietary market reports or surveys, is ideal for SEO for financial firms. Data-driven content is highly linkable and naturally attracts citations from other sites.

- HARO: Use services like Help a Reporter Out to connect with journalists from major media outlets, earning mentions and links in publications like Forbes or Nasdaq.

- Partnerships and Collaborations: Co-host webinars, publish guest posts, or develop joint case studies with other fintech firms. These collaborations build safe, relevant links, which are especially valuable for SEO for financial startups and payment systems.

Vetting Donors and Maintaining a Clean Link Profile

Link building in the financial sector demands precision. Poor-quality links can undo months of diligent work.

Always check potential linking sites for:

- Relevance: The site should be related to finance, investment, or business.

- Domain Trust: Look for a high Domain Rating (DR) or Domain Authority (DA).

- Natural Anchors: The link text should be varied and natural, avoiding over-optimized commercial phrases.

- Domain History: Ensure the site has no history of search engine penalties or association with spam.

Conduct regular link audits to identify and disavow toxic links, a crucial practice for SEO for financial services providers.

How LinkBuilder.com Drives Financial Brand Growth

LinkBuilder.com specializes in link building for complex, regulated niches like finance, banking, lending, and investments. We focus on strategies that deliver measurable organic growth and authority.

Our approach includes:

- Customized SEO for financial services strategies for banks, investment platforms, and fintech companies;

- Securing placements in authoritative industry media and journals;

- Developing original research and content designed to attract links;

- Providing transparent reporting on all platforms and campaign outcomes.

LinkBuilder.com supports clients globally, helping financial brands achieve top rankings for highly competitive queries. A sustained, quality link-building campaign can often deliver better long-term value than a year of paid advertising.

Ready to explore how link building can transform your SEO? Schedule a free consultation.

Conversion and Trust: Creating a Financial Site Users Trust and Act On

Users will not apply for loans, open accounts, or book consultations without complete confidence. SEO for financial websites is deeply intertwined with user experience (UX), design, and clear communication. Even perfect search traffic will not convert if the site feels unreliable or difficult to use.

UX and Trust-Oriented Design

Financial sites require simple, logical, and transparent designs. Complex navigation, cluttered forms, or aggressive pop-ups can quickly erode user trust.

To build confidence through design:

- Social Proof: Display logos of partners, media mentions, industry awards, and genuine client testimonials.

- Security Assurances: Prominently highlight SSL certificates, data protection policies, and clear terms of service.

- Human Connection: Include photos of team members, detailed leadership bios, and verifiable office contact information.

- Details Matter: Elements like the HTTPS lock icon in the address bar, concise button text (“Apply Now,” “Get a Quote”), and clear CTAs all contribute to a trustworthy experience.

Streamlining Forms and Application Processes

The path from interest to action must be seamless. Complex, lengthy, or confusing forms are a major barrier to conversion.

Best practices for forms:

- Limit mandatory fields to the absolute essentials (e.g., name, email, loan purpose).

- Use auto-detection for information like region or city to enhance the user experience, which also supports local SEO tips for financial services.

- Implement multi-step forms with a progress indicator (e.g., Step 1 of 3).

- Provide clear hints and descriptions for each field.

- Reassure users about data privacy and security throughout the process.

Use tools like heatmaps (Hotjar, Microsoft Clarity) and analytics to visualize user behavior, identify drop-off points, and continuously optimize the UX.

Not all visitors are ready to act immediately. Offer secondary goals, such as downloading a comprehensive guide or subscribing to a newsletter, to capture leads and maintain engagement for future nurturing.

A/B Testing and Personalization

Financial audiences are diverse. A/B testing allows you to optimize elements like headlines, button colors, and content formats based on real user data. Personalization tailors the experience to different user segments, which boosts conversion rates and sends positive behavioral signals to search engines – important for SEO for financial apps and platforms.

For example, you can display local interest rates to users from New York or highlight UK-specific regulatory information to visitors from London. For returning clients, offer personalized options like streamlined insurance renewal or pre-approved loan offers.

Analytics and Campaign Optimization: Measure, Assess, Improve

An SEO for financial services strategy without robust measurement will inevitably lose its impact. In the finance sector, it’s not just about attracting visitors – it’s about converting them into clients. Your analytics must bridge the gap between SEO activity and business outcomes.

Setting Up Analytics, Goals, and Events

A proper measurement foundation includes:

- Google Analytics: To monitor overall traffic, user behavior, conversions, and engagement metrics.

- Google Search Console: To track search queries, indexing status, ranking positions, and technical issues.

- Call Tracking and CRM Integration: To connect phone leads and online form submissions directly to their organic search source.

For SEO for financial companies, it’s crucial to attribute leads and sales back to their origin. Set up goals for key user actions:

- Contact form submissions.

- Interactions with key tools like calculators.

- Downloads of gated content (e.g., reports, guides).

- Views of high-intent pages like specific tariff or service pages.

Also, track micro-interactions (events) such as button clicks or video plays to understand user engagement and identify points of friction.

Critical Metrics for Success

Avoid evaluating SEO finance efforts solely on traffic volume. Engagement and conversion metrics provide a much clearer picture of performance:

| Metric | What It Shows | Why It Matters |

|---|---|---|

| Organic Conversions | Number of leads or sales originating from organic search | Directly ties SEO efforts to revenue |

| Conversion Rate | Percentage of organic visitors who complete a desired action | Reflects the persuasiveness and usability of your site |

| LTV (Lifetime Value) | The average total revenue generated per client over their relationship | Measures the true long-term ROI of your SEO-acquired customers |

| ROI SEO | The ratio of profit generated from SEO to its cost | Evaluates the financial efficiency of your SEO strategy |

| Avg. Position | Your average ranking in search results for target keywords | Indicates your competitiveness in search |

| CTR (Click-Through Rate) | The percentage of users who see your result and click on it | Indicates the effectiveness of your title tags and meta descriptions |

These metrics are especially crucial for SEO for financial consultants and B2B financial services, where sales cycles are long and deals are complex.

Ongoing Audits and Strategy Refinement

SEO for the finance industry is not a “set and forget” endeavor. It requires continuous adaptation as search algorithms evolve, competitors adjust their tactics, and user search behavior changes.

Regular tasks for ongoing optimization:

- Refresh and update existing articles and guides every 3–6 months to maintain accuracy and relevance.

- Use tools like Ahrefs and Google Search Console to diagnose the cause of any ranking drops.

- Conduct periodic audits of your backlink profile and technical SEO health.

- Stay informed about industry trends, such as the growth of voice search, new fintech products, or regulatory changes.

Analytics transforms raw data into actionable insights. When your decisions are driven by metrics, SEO for financial services evolves from a marketing tactic into a reliable growth engine, delivering consistent traffic and strengthening your brand authority.

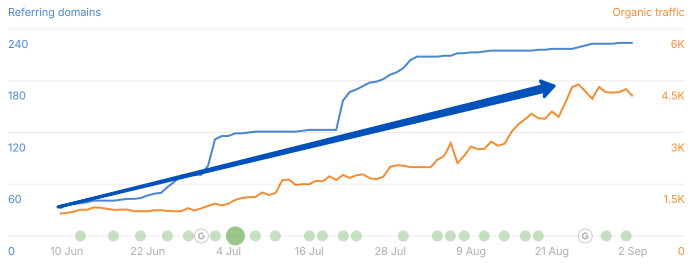

Example: Ahrefs organic traffic growth analysis.

Step-by-Step SEO for Financial Services Strategy in 2025

Effective SEO for financial companies is a systematic process, not a one-time project. Follow these steps to build a foundation for sustainable trust and search visibility.

Preparation: Audit and Goal Setting

Begin with a comprehensive diagnostic to understand your current position and identify growth opportunities:

- Technical Audit: Evaluate site speed, indexing status, URL structure, duplicate content, and mobile-friendliness.

- Content Audit: Identify which pages are driving traffic, which are outdated, and where there are gaps in your topical coverage.

- Competitor Analysis: Study the SEO strategies of leading banks, insurers, and investment platforms using tools like Ahrefs or Semrush to uncover their keyword targets and link-building sources.

- Goals and KPIs: For SEO for financial institutions, define success metrics that align with business objectives, such as a specific percentage increase in organic lead volume or a reduction in customer acquisition cost.

Step 1: Implement Technical Improvements

Technical optimization ensures your site is crawlable, fast, and secure – the bedrock of all other SEO efforts.

- Configure robots.txt and sitemap.xml correctly.

- Optimize images, leverage browser caching, and minimize code to improve loading times.

- Ensure full HTTPS implementation and fix any mixed content issues.

- Implement hreflang tags if you have an international presence.

- Prioritize mobile usability, as the majority of financial queries now come from smartphones.

A key focus should be on optimizing Google’s Core Web Vitals: LCP, INP, and CLS.

Step 2: Build a Content Strategy

Content is the fuel for SEO for financial services. Develop a detailed content map that outlines all necessary pages, update schedules, and keyword distribution.

A comprehensive Content Map should include:

- Informational Articles: Covering topics like tax strategies, insurance explanations, investment basics, and loan guides.

- Service Pages: Dedicated pages for each core offering, such as accounting services, financial consulting, specific loan products, and insurance policies.

- Research and Analytics: Original reports and data studies that build trust and authority, crucial for SEO for financial firms.

- Interactive Tools and Surveys: Calculators and quizzes that boost engagement, vital for SEO for finance companies and apps.

This structured approach helps establish topical authority, signaling to search engines that your site is a comprehensive expert in its niche.

Step 3: Enhance E-E-A-T and Build Links

Once your content is published, the next step is to build its authority and visibility.

- Ensure content is published under the names of authors with verifiable credentials and experience.

- Create robust “About Us,” “Our Team,” and “Licenses” pages to build institutional trust.

- Actively build quality backlinks through digital PR, strategic partnerships, expert outreach (HARO), and the promotion of your original research.

High-quality links from trusted sources not only improve rankings but also reinforce your reputation. This is an area where professional support can be highly effective.

LinkBuilder.com specializes in building safe, powerful links for YMYL sites, including banks, insurance companies, and financial platforms.

Step 4: Prioritize Local SEO Tips for Financial Services

For businesses with physical offices or those serving specific geographic areas, local SEO is non-negotiable.

- Claim and fully optimize your Google Business Profile.

- Ensure your Name, Address, and Phone number (NAP) are consistent across your website and all online directories.

- Actively encourage and manage customer reviews.

- Create content that targets local keywords, e.g., “small business accountant in [City]” or “apartment insurance [Neighborhood].”

This strategy enhances your visibility in local search results and Google Maps, which is vital for SEO for financial organizations with a regional footprint.

Step 5: Monitor, Analyze, and Adapt

SEO is an ongoing process of analysis and refinement. Your strategy must evolve with algorithm updates, competitive shifts, and changes in user intent.

Continuously track:

- Rankings for your target keyword portfolio.

- User behavior metrics (time on page, bounce rate, pages per session).

- The health and growth of your backlink profile.

- The volume and quality of organic leads and phone calls.

Conduct quarterly comprehensive SEO audits, experiment with new content formats (e.g., video, podcasts), and refine your CTAs to stay ahead of the competition.

How LinkBuilder.com Brings This Strategy to Life

LinkBuilder.com specializes in SEO for financial services, with a proven track record in competitive, regulated niches. We develop and execute tailored strategies for banks, insurers, fintech firms, and investment platforms across the USA, Europe, Asia, and Africa. For concrete evidence of our work, review our case study on a Dubai fintech’s SEO success, which details significant growth in traffic, Domain Rating (DR), and Domain Authority (DA) within four months.

We provide end-to-end support:

- Conducting in-depth audits to pinpoint the most impactful growth opportunities.

- Developing a data-driven content and keyword strategy.

- Implementing all necessary technical and on-page improvements.

- Executing a powerful link-building and digital PR campaign.

Ready to scale your SEO for finance? Book a consultation with LinkBuilder.com to discuss your goals, review relevant case studies, and create a customized plan for your business.

SEO for Financial Industry: Tailored Strategies for Each Segment

Every segment within the financial sector demands a nuanced approach to SEO for financial services. While the core principles of Google’s algorithm remain constant, client behavior, search intent, and expectations can vary dramatically.

SEO for Banks and Online Banking: Convenience, Security, Trust

For banks, the primary focus must be on reliability and transparency. Clients prioritize security and trust as much as competitive rates and products.

Key Focus Areas:

- Robust technical performance and unequivocal data security (SSL, encryption, two-factor authentication).

- Fast load times and an intuitive, user-friendly interface.

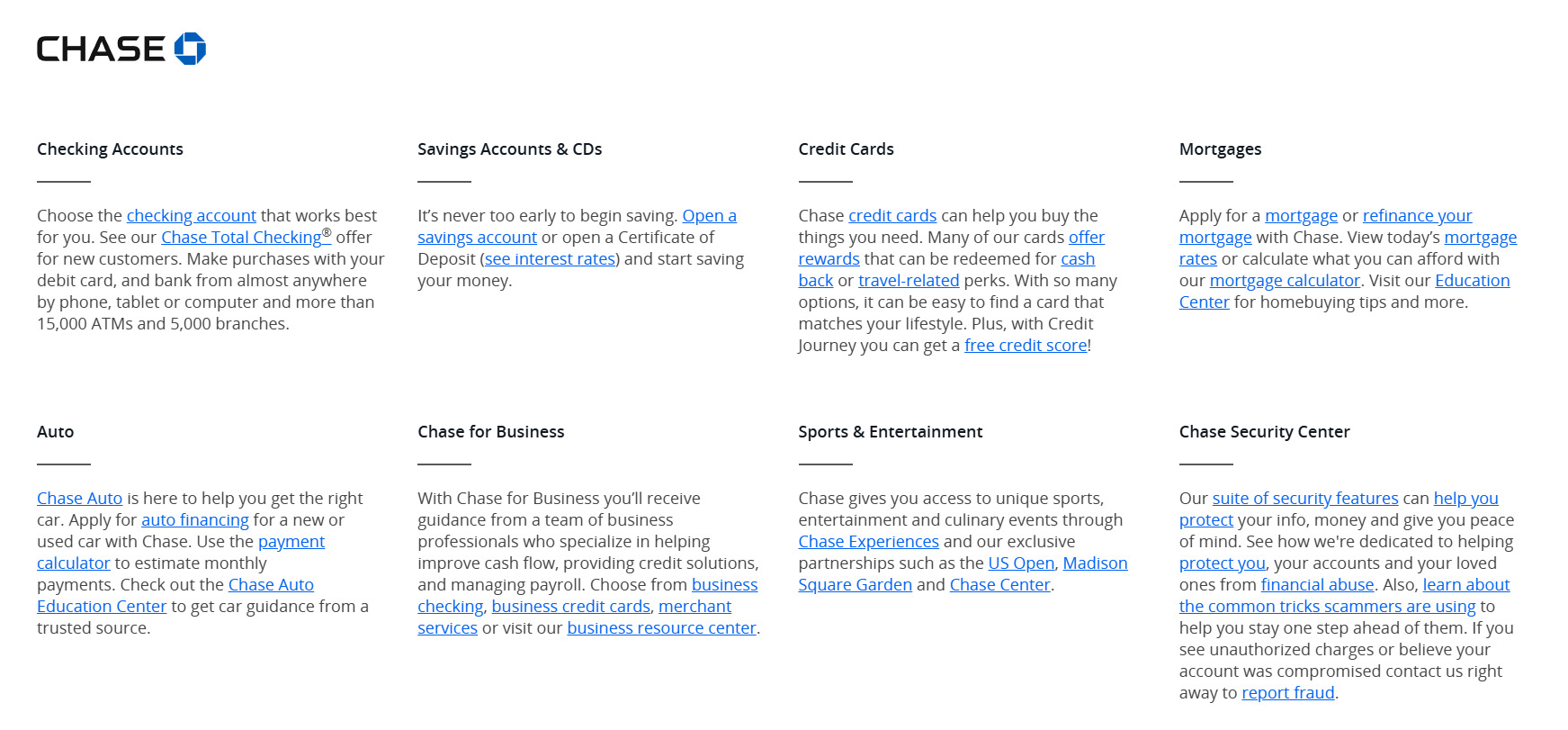

- Well-structured, segmented content for all key products: mortgages, personal loans, credit cards, savings accounts.

- Interactive tools like loan calculators and comprehensive FAQ sections.

- Optimization for both branded queries and “near me” searches for local branches.

Demonstrating E-E-A-T is critical for SEO for financial institutions. This includes clear author bios, citations of sources, and total legal transparency.

Example: Chase’s homepage, showcasing clear product categorization.

SEO for Insurance Companies: Building for the Long Term

The insurance industry is built on trust and comparison. Users conduct extensive research before making a purchase decision.

Main Priorities:

- Develop useful tools like premium calculators and coverage comparison features.

- Create clear, accessible content that explains policy details and fine print.

- Leverage genuine client testimonials and detailed case studies.

- Build authoritative links through industry portals and independent product review sites.

SEO for insurance websites requires creating in-depth, educational content and keeping it meticulously updated to reflect changing regulations and rates.

Example: GEICO’s user-friendly auto insurance calculator.

SEO for Investment Platforms and Brokers: Educate, Engage, Retain

This audience seeks expertise and clarity, not aggressive sales pitches.

Key Strategies:

- Produce high-value educational content: trading strategy guides, market analytics, video tutorials.

- Feature qualified authors (e.g., certified financial analysts) to prove expertise.

- Optimize landing pages for specific investment verticals: stocks, ETFs, bonds, cryptocurrencies.

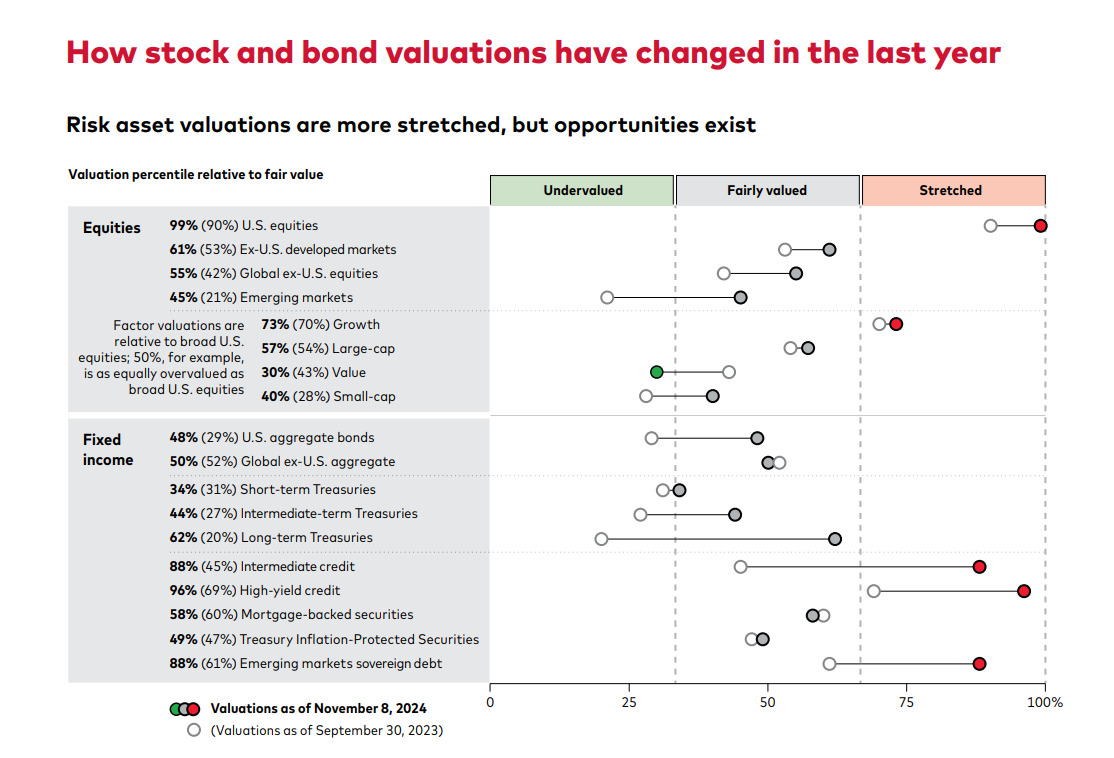

- Use data visualizations, charts, and graphs to make complex information digestible.

- Secure backlinks from reputable financial news outlets and analytical portals.

SEO for financial firms in the investment space must strike a balance between demonstrating deep expertise and presenting it with simplicity to drive trust and action.

Example: Vanguard’s authoritative market trends report.

SEO for Microfinance Organizations: Competing for Hot Leads

MFOs operate in a high-competition, high-cost-per-click environment, where speed and simplicity are paramount.

Effective Tactics:

- Create highly optimized, conversion-focused landing pages for queries like “payday loan online” or “quick cash credit.”

- Minimize friction: use short application forms and emphasize instant approval processes.

- Employ strong, direct CTAs, and use micro-animations and FAQs to address key concerns immediately.

- Focus intensely on local SEO tips for financial services due to the geographic nature of their lending.

- Be prepared to update content rapidly in response to regulatory changes.

Maintaining a pristine link profile is especially important, as MFOs are often targeted by low-quality link networks.

SEO for Financial Consultants and Accounting Services (B2B and B2C): Personal Brand and Expertise

Success here hinges almost entirely on the perceived expertise and trustworthiness of the individual or team.

Key Aspects:

- Build a strong personal brand with professional photos, detailed biographies, published articles, and media mentions.

- Publish regular, insightful commentary on topics relevant to both businesses and individuals.

- Optimize meticulously for local search queries like “financial consultant in Miami” or “small business accountant in Los Angeles.”

- Showcase client testimonials and detailed case studies that prove your results.

- Seek to publish content on established platforms like Forbes or Business.com to earn quality backlinks and build authority.

SEO for accounting services and consultants is fundamentally about leveraging personal reputation to drive visibility and conversions.

Key Takeaways

The financial market in 2025 is a battleground where trust is the ultimate currency, outweighing short-term advertising gains. SEO for financial services has evolved into a core business strategy, directly influencing revenue and long-term stability.

Developing and executing an effective strategy requires deep industry knowledge and dedicated resources. In-house teams without specialized SEO expertise often find themselves wasting both time and budget on ineffective tactics.

Ready to elevate your financial brand and transform search traffic into a consistent pipeline of qualified clients? Partner with experts who understand the landscape. Contact LinkBuilder.com, a specialist financial services SEO agency for banks, insurers, fintechs, and investment platforms. We build integrated systems that deliver measurable results, 24/7.